Governor John Kasich may be the only prominent elected official who appears to be seriously concerned about the national debt. In a December 14 op-ed in the Washington Post, Kasich wrote:

Do deficits matter? Clearly, the White House and a substantial number of congressional Republicans can’t decide. On one hand, they sound like cost-cutting deficit hawks when out on the stump or issuing tweets. But once the TV lights go off, they turn tables to support record spending and deficit-driven borrowing that have left us with an unprecedented burden of national debt — more than $21 trillion today and counting.

The causes of the paralysis described by Kasich are not difficult to identify and there are culprits in both parties. On the spending side, Democrats are consistently and adamantly opposed to reform of the entitlements–Social Security, Medicare and Medicaid–that account for a large and increasing portion of federal spending. For their part, Republicans are addicted to tax cuts, in denial of, or oblivious to, their effects on deficits and the debt. Several of the tributes to President George H. W. Bush recalled his decision to support a tax increase in 1990, abandoning his “Read my lips” pledge. Many observers believed that breaking that pledge may have led to Bush’s defeat in 1992. Not surprisingly, perhaps, it was an act of fiscal prudence and political courage that Republicans have since been unwilling to repeat.

By coincidence, on December 13, the day before the Kasich op-ed, the Congressional Budget Office (CBO) published a report titled “Options for Reducing the Deficit: 2019 to 2028.” With the exception of the always reliable Committee for a Responsible Federal Budget (CRFB), the CBO report has been ignored in the media. But it is an important document setting forth where we are today, where we appear to be headed, and what some of the options are.

In the report, the CBO summarized the current deficit and the projected increase in the national debt:

The federal budget deficit in fiscal year 2018 totaled $779 billion—3.8 percent of gross domestic product, or GDP. That deficit represented an increase from the 2017 deficit, which equaled 3.5 percent of GDP. As a result, debt held by the public increased to 78 percent of GDP at the end of 2018— about 2 percentage points higher than the amount in 2017 and the highest percentage since 1950.

According to the CBO’s projections, the debt will grow to 96% of Gross Domestic Product, or $29 Trillion, by 2028 and increase even more sharply after that. The consequences of that development would be severe. Described in in dry bureaucratic language:

Federal spending on interest payments would rise substantially as a result of increases in interest rates, such as those projected to occur over the next few years. Moreover, because federal borrowing reduces national saving over time, the nation’s capital stock ultimately would be smaller, and productivity and income would be lower, than would be the case if the debt was smaller. In addition, lawmakers would have less flexibility than otherwise to respond to unexpected challenges, such as significant economic downturns or financial crises. Finally, the likelihood of a fiscal crisis in the United States would increase. Specifically, the risk would rise of investors’ becoming unwilling to finance the government’s borrowing unless they were compensated with very high interest rates.

Put more bluntly, the fiscal course we are now following is not sustainable. It is difficult to argue with CBO’s conclusion that, in order to put the budget on a long term path that is sustainable, major policy changes must be made to reduce spending or increase revenue or both.

On the spending side, the CBO report pointed out that mandatory spending totaled about $2.8 trillion in 2017, or 70 percent of federal outlays. The largest mandatory programs are Social Security and Medicare which together accounted for 60 percent of mandatory outlays in 2017. Medicaid and other health care programs accounted for 16 percent of mandatory spending. Moreover, CBO expects that spending on Social Security and health related programs, principally Medicare, will account for almost two thirds of the increase in mandatory spending over the next decade.

Consistent with the general Republican perspective, Kasich placed most of the blame for deficits on spending, but he also referred to “unpaid-for tax cuts,” of which the 2017 “Tax Cuts and Jobs Act” is a recent and flagrant example. In April, the CBO projected that, during the next decade, the 2017 Act would add $1.9 trillion to the debt—even after giving credit for economic growth; the increase in the deficit for 2018 alone was estimated to be $164 billion. After the Treasury Department reported the deficit for fiscal 2018 to be $779 billion, an analysis in USA Today on October 16 estimated the increase in the deficit attributable to the 2017 Act to be $202 billion. The analysis was particularly critical of Secretary of the Treasury Steven Mnuchin and Budget Director Mick Mulvaney for refusing to acknowledge the impact of the Act:

Last week, Mnuchin said it was the Democrats’ demand for more spending on health care and education that was the sole reason the deficit was increasing.Shortly after Treasury released its report, Mulvaney said the deficit was due to “irresponsible and unnecessary spending.” He didn’t mention the tax cuts at all. Mnuchin and Mulvaney should both be embarrassed by these obvious attempts at budget misdirection, but Mnuchin should be especially ashamed. It is Treasury, the department he leads with a staff that reports to him, that has exposed the tax law as the real reason the federal deficit is increasing so steeply.

But wait, as they say on late night TV ads, there’s more. Roll Call reports that, ignoring the old adage that, if you’re in a hole stop digging, House Republicans are preparing a year end tax package estimated to cost another $100 billion over ten years. (An even more ambitious scheme for a middle-class tax cut, floated before the mid-terms, now appears to have “dried up like a raisin in the sun,” as one observer put it.)

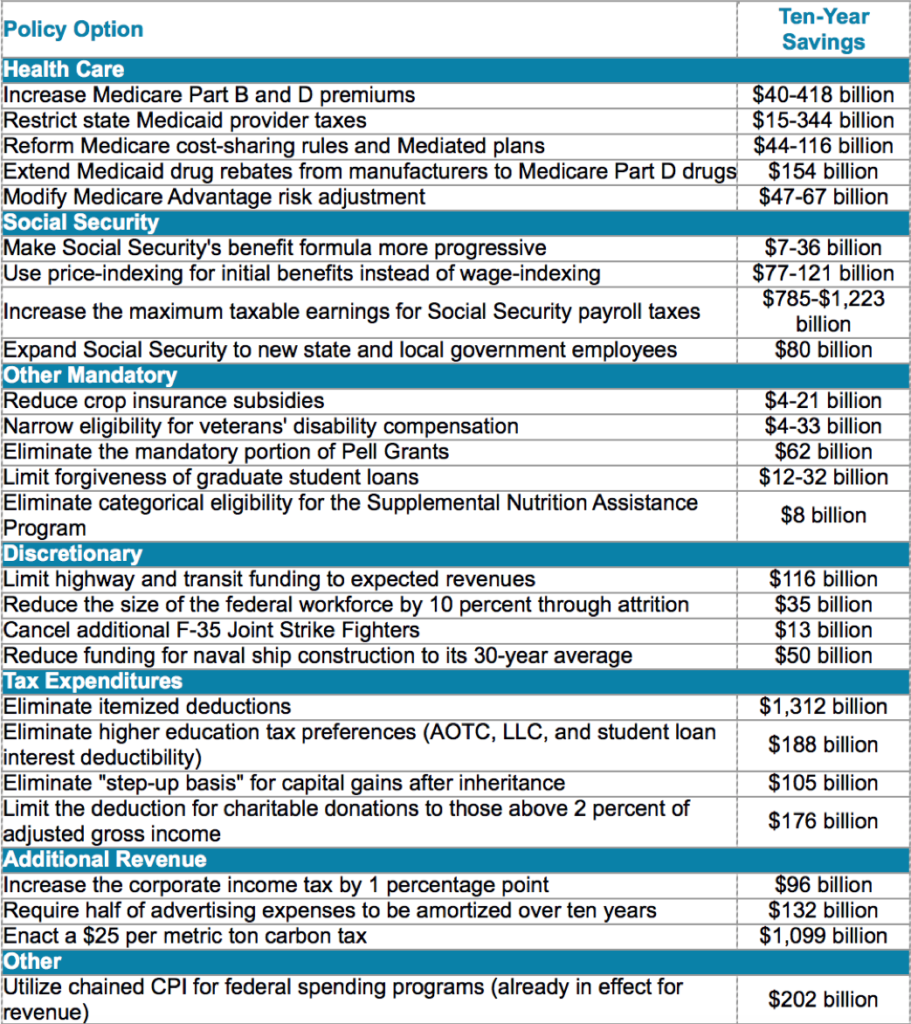

The December CBO report enumerated a wide range of options for reducing spending and increasing revenue. The CRFB compiled a table showing some of the options in each of several categories. The options are described in detail in the CBO report, which also contains arguments for and against implementation of each option, an explanation of how the change could affect beneficiaries, and other detailed analyses. The CRFB table is reproduced here to give readers a picture of some of the possibilities.

Source: Congressional Budget Office

Some of the options identified by the CBO may be unwise and many may be politically unacceptable, but collectively they represent the kind of choices that will have to be considered and made if a fiscal debacle is to be avoided.

Correction. As initially posted, the blog referred to revenue in 2018 of $779 billion. The reference should have been to a deficit of $779 billion

Thank you Doug for the interesting CRFB Chart. Having the Chart available may help a citizen understand the budget arguments going forward. Larry

Comments are closed.