Writing, and no doubt reading, about budgets is not as much fun as writing about the pronouncements of the Tweeter in Chief and various misadventures of the Trump White House. But the budget is an important matter, so even a further look at the peculiar saga of Trump and the Russians will be temporarily deferred, and perhaps readers will tolerate a brief slog through some depressing numbers. The Bipartisan Budget Act of 2018 (BBA or the Act) was passed by the House and Senate on February 9 and signed by President Trump on that same day. Three days later Trump released his budget for fiscal year (FY) 2019 (the Budget). The two documents vary significantly, but had this in common: both charted a path of fiscal irresponsibility.

The Bipartisan Budget Act

The BBA, it must be admitted, was a positive achievement in four fundamental respects. First, it avoided a government shutdown (except for a few early morning hours). Shutdowns, and threats of shutdowns, are simply not an acceptable way of governing. Second, the BBA waived the debt ceiling until March 2019. Debates over raising the debt ceiling are at least as pointless and destructive as shutdowns. Third, the Act was the product of genuine bipartisan negotiations in the Senate, a hopeful sign that gridlock is not inescapable. Fourth, it allowed increased funding for many worthwhile programs, both military and domestic.

On the other hand, the BBA does not deserve a full-throated approval, primarily because of its impact on the federal debt, particularly on the heels of the recent tax “reform” bill. In addition, the Act was not developed through open hearings but created in secret negotiations among Senate leaders, with its provisions being disclosed only the day before it was put to a vote. Unsurprisingly, that process allowed spending not only for programs that are essential or worthwhile, but for others that are questionable.

Total Funding Approved

The BBA gave Congress the authority to spend $500 billion more than had been allowed under existing budget caps through fiscal year (FY) 2019. There are a few “pay fors” in the deal, but the official word from the nonpartisan Congressional Budget Office was that, if fully implemented, the Act would add $320 billion to the deficit. The package included a short-term spending measure that will keep the government running through March 23. During that period, Congress must convert the Act’s overall funding levels into the detailed appropriations that will fund the government through September of FY 2018. Separate consideration will be given to FY 2019, first through the Budget and then through appropriations bills (or, if necessary, continuing resolutions.)

Military funding. The BBA increased allowable military spending by $80 billion in this fiscal year and $85 billion in FY 2019, plus $140 billion over two years for an emergency war fund. Secretary of Defense James Mattis had given compelling testimony in Congress on the need for increased military funding and there was broad bipartisan support for a substantial increase. Nevertheless, the new budget arguably allows more than might be necessary. An analysis in the Washington Post commented:

The [amount budgeted] removes any pressure for the military to embrace change. For example, the Pentagon said it has 22 percent excess base capacity that it would like to close. The extra money also removes pressure to cut weapons systems that some say are better suited to the last war, such as the A-10 attack jet or the U2 high-altitude surveillance plane.

Domestic Funding. The BBA increased allowable domestic spending by $63 billion this fiscal year and $68 billion the following year.

The Wall Street Journal no doubt spoke for many Republicans in grumbling that the needed funding for military renovation came at a “high price” in the form of the increase in domestic spending: “Democrats backed up the truck for funding on everything from community health centers to billions on child-care grants to $20 billion for infrastructure.” One item in particular that seemed to irritate the Journal was the children’s health insurance program:

On the long list of the Democratic haul: An additional four-year extension for the children’s health insurance program, or CHIP, which was recently extended for six years. That means 10 more years of a separate health program for children, though many Democrats said that ObamaCare would provide affordable coverage that would make the CHIP program unnecessary. Now we get both for the long run.

The Journal’s attack appears misplaced. Whatever Democrats may have once said, it is clear that the Affordable Care Act has not made to CHIP program unnecessary and will hardly do so as the Trump administration continues its attempts to dismantle the ACA. Moreover, CHIP is not merely a Democratic priority but a program that has enjoyed strong support among Republicans, led by Senator Orrin Hatch.

Another point of criticism from the Journal was the budget allowance for dealing with the opioid crisis:

The deal also includes $6 billion for the opioid crisis, though it’s hardly clear that communities or the health-care system are prepared to absorb more cash. Congress allocated $1 billion for state grants in a 2016 law, and little is understood about what this funding has accomplished. For now this spending is a bipartisan hall pass for not having to think about tougher problems like why so many Americans are declining treatment and overdosing multiple times.

In fact, $6 billion is a small fraction of what many experts believe will be necessary to deal with the crisis. The $6 billion, and hopefully more, should be accompanied by robust Congressional oversight to assure that the money is not only spent but spent wisely. Adequate funding will surely help experts to “think about” the problems the Journal identifies as well as many other vexing questions that must be addressed.

The Journal acknowledged that the $90 billion allocated for disaster relief was probably inevitable, but could not refrain from whining that “plenty of it is sure to be wasted.” And so, no doubt, it will be—just as will “plenty” of the billions allocated to the Pentagon with the Journal’s undiluted enthusiasm. Politicians and editorial writers love to inveigh against “waste, fraud and abuse,” but as someone once noted, that dismal trilogy is never listed as a line item in the budget.

Not surprisingly perhaps, the Journal did not question the extension of various tax breaks that many might have thought had been made unnecessary by the recent tax legislation. The Journal also made no mention of funding for abstinence education, which has been shown to be of dubious effectiveness, and more than $1 billion allocated to help cotton and dairy producers who have complained that federal programs aren’t enough when market prices are low and production costs are high.

The Fiscal Impact

Senator Rand Paul carried out a mini-filibuster of the BBA that delayed its passage by several hours, complaining of its fiscal irresponsibility. While Paul had a point, his performance served no purpose except to irritate his colleagues. The spending authorized by the Act was, for the most part, clearly needed and few had the stomach for another quixotic shutdown. Paul himself was a flawed champion of fiscal responsibility as he had enthusiastically supported the recent tax bill, which will add add least $1 trillion to the deficit.

In discussions of fiscal responsibility, the Committee for a Responsible Federal Budget (CRFB) is often one of the few sober and responsible voices in the room. On this occasion, the Committee pointed out that the long-term impact of the Act even exceeds the $320 billion projected by the CBO. According to the Committee, the CBO estimate reflects near-term costs and that if temporary provisions in the Act are made permanent, the ultimate cost could increase to $1.7 trillion, or $2.1 trillion including interest, and increase the national debt to 105 percent of Gross Domestic Product (GDP) by 2027.

The Washington Post summed up the fiscal and political situation reflected in the budget bill:

The deal reconfirms that there is a lot of agreement about what the government should be doing and, therefore, roughly how large it will remain. Lawmakers differ only in their degrees of denial about how much it costs to provide the services Americans expect. One month, Republicans pass a massive tax cut that will add more than $1 trillion to the debt; next, Democrats join them on a budget plan that hikes spending. The result is a big, unsustainable gap between revenue and outlays — just as the nation should be husbanding its resources for the next economic crisis and preparing to pay for the baby boomers’ retirement.

The Trump Budget

The Trump budget proposes spending for FY 2019 totaling $4.4 trillion producing a deficit of $984 billion. To the extent that the Budget nods in the direction of fiscal responsibility, it does so by way of reductions in domestic spending. The initial FY 2019 Budget called for Non-Defense spending of $465 billion, but an addendum to the Budget, reflecting the increase in budget caps allowed by the BBA, added $75 billion for a total of $540 billion (compared to a total of $716 billion for military spending). Even with the increase, the total amount for domestic spending was $57 billion less than the $615 billion that could have been spent under the BBA. In assessing deficits in future years, the Budget, like supporters of the Tax Reform Bill before it, relies heavily on highly optimistic projections of doubtful credibility. The Budget forecasts that debt would fall to 73 percent of GDP by 2028, but the CRFB sees a very different future:

[T]he budget relies on extremely optimistic and unrealistic economic growth assumptions and numerous budget gimmicks, and it does not fully incorporate deficit spending from the recent Bipartisan Budget Act of 2018. In reality, while the President’s proposals would likely reduce projected deficits relative to their current trajectory, deficits and debt would likely continue to rise unsustainably under the President’s proposals.

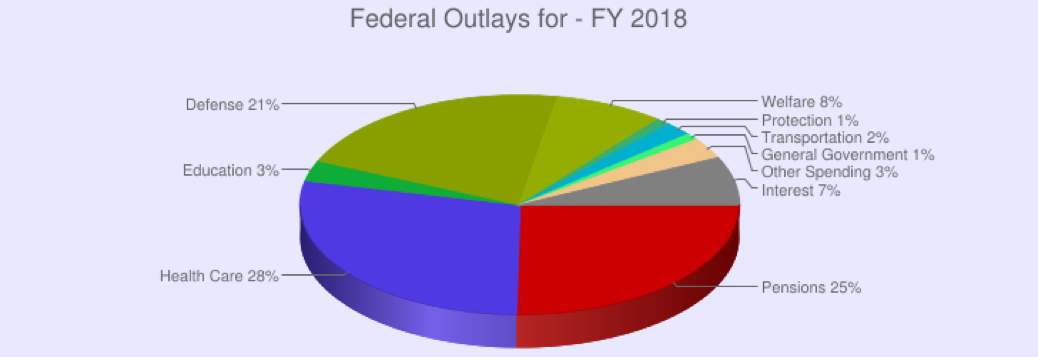

Reductions in domestic spending included proposed cuts to programs like Medicare, Medicaid and food stamps, and leaner budgets across federal agencies, including the Environmental Protection Agency. Progressives decried the reductions in such domestic programs by comparison with both the “tax expenditures in the recent tax bill and the size of the military budget. The former objection is more persuasive. As a proportion of the overall budget, defense spending is not the major driver of the deficit. The government chart below illustrates the point.

The Budget does propose programmatic changes to Social Security (in the Social Security Disability Program) but as the CRFB, has pointed out, the effect of those changes has been exaggerated by some critics of the Budget:

It is certainly true that the budget proposes substantial reductions in Medicaid spending, but the proposed savings from Social Security and Medicare are in fact quite modest in size, would have little effect on benefits, and would actually reduce out-of-pocket health care costs for most seniors.

In fact, the Social Security, Medicare and Medicaid programs are all candidates for structural reform as the report of the Simpson-Bowles Commission demonstrated in 2010. The intervening seven years have served only to make the Commission’s message more urgent. The federal debt that was $14 trillion at the end of 2010 now exceeds $20 trillion. Yet support for reform of Social Security and Medicare is not to be found among Democrats, President Trump or, it would appear, a majority of Republicans on Capitol Hill. Eventually, however, the debt will have to be paid one way or another and it is our children and grandchildren who will do the paying.

Our government is out of control and, were it to continue on its present path, is at risk of becoming a Third World country. A country riven by greed and corruption in which a majority of people live in poverty.

The events of the past 13 months are a frightening example of where it seems to be headed. As a young adult in the late 60s, it would have been unimagible to me that such an odious person could ever be elected president of the United States.

As for our debt-ridden society, it has not been in such dire financial straights during “peacetime” since the founding of the Republic or the Great Depression. Now it is stumbling into an even worse ccndition.

The roots of our despair are not hard to see. First, the ideals that bound us together as one nation — a love of freedom and a firm belief that any American could move up the economic ladder — are becoming mere platitudes. Not just in Congress and the White House, but in our schools, churches and corporate boardrooms.

Second, our generation of older Americans has failed to prepare for the future, and, indeed, acted selfishly without concern for future generations. We have even failed to take reasonable steps to prevent the slaughter of children in our elementary schools. It’s ”Each man for himself and the devil take the hindmost.”

I love my country and am proud of its numerous accomplishments. As I remarked to a young woman in Amsterdam who was bashing the United States: “We invented the f___ing lightbulb.”

What we need urgenntly is an intense committment to education in all branches of human knowledge. Armed with such knowledge, our descendants will have a balancced view of the world and of our proper place in it. They will be equipped to make intelligent choices about national and local priorities. They will know how to live better without frivolities and conspicuous consimption.

We have a long way to go but, being an American, I am also an optomist and believve we can get there. We must live by the Golden Rule and follow in the words of Jack Kennedy at his first inaugural: “Ask not what your country can do for you, but what you can do for your country.”

Hi Doug,

I am in Oman, so this note will be short.

We are in lock step in regards to the military budget increases.

If our country is to continue being the force behind freedom in all parts of the world and if we are to be considered the trusted ally in doing so, there is no other option. Perhaps, if our friendly countries step up to the minimum agreed funding for their military/defense, our military can ask for less as we go forward.

My bias, as a more than four year veteran , should be considered when reading my comments.

Best,

Bob

What disturbs me most about both budgets – the BBA and the Budget – is the unutterable silence re. cyberwarfare. Now, whether this threat facing us will be addressed in committee as these two budgets are sifted through remains to be seen. But, that Medicaid, Medicare and other bugaboos of the Right are directly singled out for cuts while the need to fund enlarging and strengthening our cyber infrastructure goes unmentioned, smacks of utter irresponsibility; this, especially in the (in this reader’s mind) unjustified increase in military spending (remember, if you will, that millions are still being thrown down the rabbit hole of missile defence and that, with all the resources human, technical and financial that our military has been enjoying over the years it took a private enterprise at its own expense to solve the problem of re-usable boosters…well, talk about money well-spent!) So, Doug, I disagree with you about the need to continue funding the military’s ever-jncreasing appetite for taxpayer dollars in the amounts they always plead for. What’s really needed in our military is persons of the creative problem-solving genius of an Elon Musk.

I did not suggest that the military should be funded in the ” amounts they always plead for” and specifically noted both that the amount in the BBA might be more than necessary and that waste inflicts military and domestic budgets alike. I did indicate, and believe, that Mattis and others made a compelling case for annincrease in the defense budget.

Cyberwafare was not ignored in the Trump Budget:

“Prioritizes Cyber Activities. The Budget continues to place a high priority on cyber security and

those responsible for providing it by requesting more than $8 billion in 2019 to advance DOD’s three

primary cyber missions: safeguarding DOD’s networks, information and systems; supporting military

commander objectives; and defending the Nation. This investment would also provide the necessary

resources to sustain the 133 Cyber Mission Force (CMF) teams established at Cyber Command.

Since their inception in 2013, the CMF teams have grown in capability and capacity, and all teams

are on track to be fully operational by the end of 2018.”

Whether the requested amount, and the programs themselves are adequate, is something I don’t know enough about to have an opinion.

Doug, I stand corrected.

My father, a Navy lifer and conservative, expressed concern when Reagan increased the defense budget by a huge amount. He likened it to firehosing a dry mound of dirt. Most of the funds would be wasted.

Karen – your father was right. And so was President Eisenhower when he said in his farewell address, “Beware the military-industrial complex.”

-Roger

Comments are closed.